On February 24, 2026, President Donald Trump delivered the first State of the Union address of his second term. While the speech does not directly change landlord laws, it outlines national priorities that can influence housing policy, tax legislation, immigration enforcement, trade policy, and economic direction. For rental property owners, these policy signals matter. Rental …

Category: Landlord Education

State of the Union 2026: What Rental Property Owners Should Know About Housing, Taxes & the Economy

FTC Begins Rulemaking on Rental Fee Transparency: What Landlords Should Know

On January 30, 2026, the Federal Trade Commission (FTC) announced it is beginning the rulemaking process related to fees in the rental housing market. Before going further, one key point: Nothing has been implemented yet.The FTC has only issued an Advance Notice of Proposed Rulemaking (ANPRM). There is no final rule, and the process could …

Continue reading “FTC Begins Rulemaking on Rental Fee Transparency: What Landlords Should Know”

Insurance Costs Are Crushing Landlords — What to Do

If you own rental property in 2026, you’ve likely felt it already. Your renewal notice arrives… and the premium is up 15%, 25%, sometimes more. Deductibles increase. Coverage terms tighten. Carriers ask more underwriting questions. Umbrella policies cost more than they did just a few years ago. Insurance has quietly become one of the fastest-growing …

Continue reading “Insurance Costs Are Crushing Landlords — What to Do”

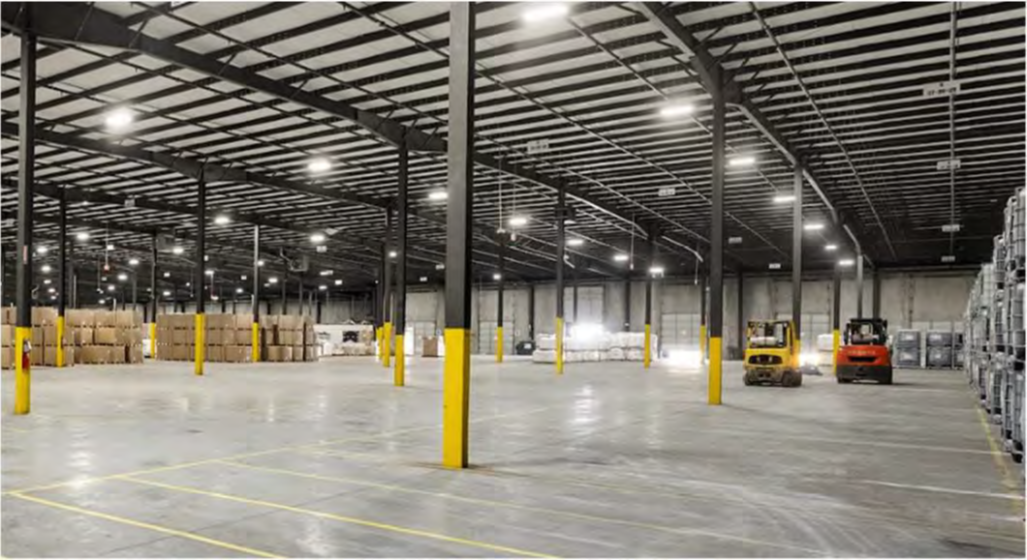

Why Industrial Real Estate Is One of the Most Compelling Asset Classes Right Now

While much of the real estate conversation today centers on what’s struggling — office vacancies, higher borrowing costs, and tighter margins — one asset class continues to quietly perform: industrial real estate. Industrial properties don’t rely on consumer sentiment or trendy amenities. They support the real economy — manufacturing, logistics, distribution, and storage. That makes …

Continue reading “Why Industrial Real Estate Is One of the Most Compelling Asset Classes Right Now”

The Growing Push for Tenant Unions — What Landlords Should Know

Over the past year, a new phrase has been showing up more often in real estate headlines: tenant unions. Historically, tenant unions were rare in the U.S. and typically limited to a handful of large, distressed multifamily properties in major cities. But that’s beginning to change. Recent high-profile cases — including efforts by tenants at …

Continue reading “The Growing Push for Tenant Unions — What Landlords Should Know”

A Real-Life Story That Shows the True Power of Rental Properties

I follow a lot of real estate investing blogs, podcasts, and newsletters. Most focus on the latest strategies—creative finance, short-term rentals, exotic markets, or whatever the current trend happens to be. Every once in a while, though, a story cuts through the noise and serves as a powerful reminder of why plain, boring rental real …

Continue reading “A Real-Life Story That Shows the True Power of Rental Properties”

Value-Add Renovations in a Shifting Rental Market: How Forward-Thinking Owners Stay Ahead

At Rentals America, we don’t just manage properties — we study markets. Over the past several years, many U.S. rental markets have experienced dramatic cycles. Rapid population growth, record-setting rent increases, and unprecedented new construction have reshaped the landscape for owners and investors alike. As we move into 2026, the rental market is transitioning into …

Why the FTC Is Suing Zillow and Redfin — and Why Landlords Should Care

In a major antitrust case, the Federal Trade Commission (FTC) has filed a lawsuit against Zillow and Redfin over what it claims was an unlawful $100 million rental advertising deal that reduced competition in the online rental listing market. While this may sound like a dispute between tech giants, the outcome of this case could …

Continue reading “Why the FTC Is Suing Zillow and Redfin — and Why Landlords Should Care”

The Smarter Way to Own Real Estate in Multiple Markets

Most real estate investors understand the power of geographic diversification. Far fewer understand how to achieve it without turning their investing journey into a web of distant contractors, unknown markets, and scattered tax filings. Investors don’t need to personally own properties in Phoenix, Dallas, Nashville, Tampa, and Boise to capture the benefits of nationwide real …

Continue reading “The Smarter Way to Own Real Estate in Multiple Markets”

Limited Space Still Available in Our Houston Self-Storage Investment Opportunity

If you’ve been waiting for a strong real-estate investment to diversify beyond rentals, our current Houston self-storage deal still has limited space available—and we’re opening it to our broader community before it closes. This opportunity is part of our Passive Investment Club, and for many investors, it’s ideal first step into hands-off, cash-flowing real estate. …

Continue reading “Limited Space Still Available in Our Houston Self-Storage Investment Opportunity”